8 Easy Facts About Automobile Insurance In Toccoa Ga Explained

Wiki Article

The Main Principles Of Commercial Insurance In Toccoa Ga

Table of ContentsThe Ultimate Guide To Health Insurance In Toccoa GaAnnuities In Toccoa Ga Fundamentals ExplainedWhat Does Insurance In Toccoa Ga Do?The 9-Second Trick For Automobile Insurance In Toccoa Ga

An economic expert can also help you choose exactly how ideal to attain goals like saving for your kid's university education and learning or paying off your financial obligation. Economic consultants are not as fluent in tax obligation law as an accountant could be, they can provide some guidance in the tax obligation planning process.Some economic experts use estate planning services to their customers. They may be learnt estate preparation, or they may wish to deal with your estate lawyer to address inquiries about life insurance policy, depends on and what ought to be performed with your financial investments after you die. Finally, it is necessary for financial consultants to keep up to day with the market, financial conditions and advising finest methods.

To offer financial investment products, advisors need to pass the pertinent Financial Market Regulatory Authority-administered exams such as the SIE or Series 6 examinations to get their certification. Advisors who want to market annuities or other insurance policy products need to have a state insurance policy permit in the state in which they plan to market them.

10 Simple Techniques For Affordable Care Act Aca In Toccoa Ga

You work with a consultant that bills you 0. Because of the normal fee framework, several consultants will not work with customers that have under $1 million in properties to be taken care of.Financiers with smaller sized portfolios may look for out a financial expert that charges a hourly cost as opposed to a percent of AUM. Hourly costs for advisors usually run between $200 and $400 an hour. The even more complex your monetary scenario is, the even more time your advisor will certainly have to commit to managing your assets, making it more expensive.

Advisors are competent specialists that can help you create a strategy for monetary success and execute it. You may likewise take into consideration connecting to an expert if your individual economic conditions have actually lately come to be a lot more difficult. This can suggest buying a house, getting wedded, having children or getting a huge inheritance.

The Only Guide for Health Insurance In Toccoa Ga

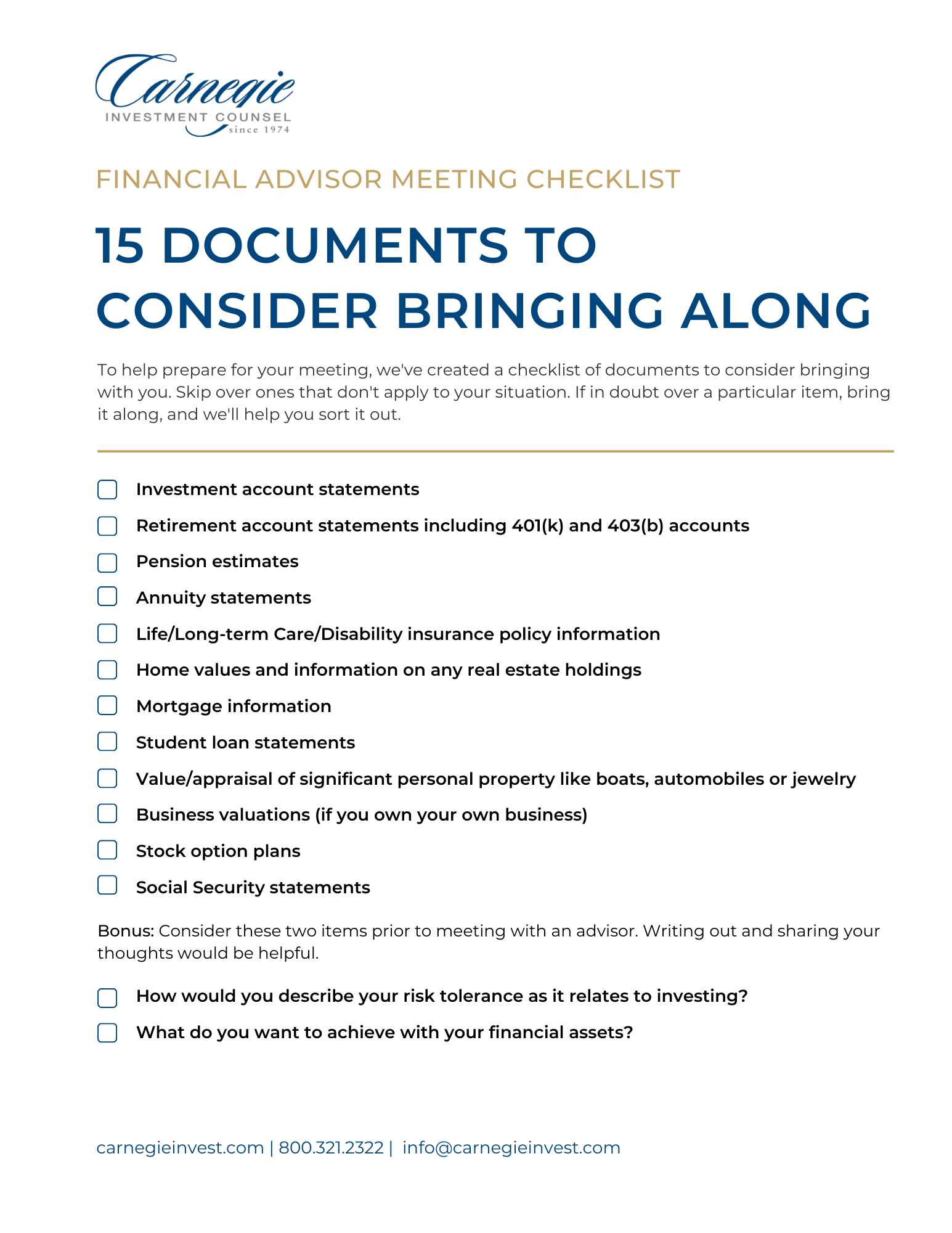

Before you satisfy with the expert for a first assessment, consider what services are most important to you. You'll desire to look for out an expert that has experience with the solutions you want.What business were you in before you got into economic advising? Will I be working with you straight or with an associate consultant? You might likewise desire to look at some example financial strategies from the consultant.

If all the samples you're given are the very same or similar, it might be a sign that this expert does not effectively customize their guidance for every client. There are three major types of monetary advising professionals: Certified Economic Planner specialists, Chartered Financial Analysts and Personal Financial Specialists - https://www.artstation.com/jstinsurance14/profile. The Licensed Financial Coordinator expert (CFP specialist) certification indicates that an advisor has satisfied an expert and moral standard set by the CFP Board

What Does Final Expense In Toccoa Ga Mean?

When selecting an economic expert, think about a person with an expert credential like a CFP or CFA - http://peterjackson.mee.nu/do_you_ever_have_a_dream#c1891. You may likewise take into consideration an expert that has experience in the solutions that are most important to youThese experts are normally riddled with conflicts of passion they're a lot more salespeople than advisors. That's why it's critical that you have an expert that works just in your benefit. If you're searching for an advisor that can really offer actual value to you, it is essential to research a variety of potential alternatives, not just select the given name that advertises to you.

Presently, lots of advisors need to act in your "best passion," but what that requires can be nearly unenforceable, other than in one of the most egregious instances. You'll need to find an actual fiduciary. "The very first test for an excellent monetary consultant is if they are benefiting you, as your advocate," says Ed Slott, CPA and founder of "That's what a fiduciary is, yet everyone says that, so you'll require various other indicators than the advisor's say-so and even their qualifications." Slott suggests that click here to find out more customers seek to see whether consultants buy their continuous education and learning around tax preparation for retirement savings such as 401(k) and IRA accounts.

0, which was passed at the end of 2022. "They need to confirm it to you by showing they have taken severe recurring training in retirement tax and estate preparation," he says. "In my over 40 years of method, I have actually seen costly permanent tax obligation mistakes due to ignorance of the tax obligation policies, and it is sadly still a large trouble." "You ought to not attach any type of expert who doesn't buy their education and learning.

Report this wiki page